The profitability question in a case interview is a classic. There’s a very high chance you’ll have to solve some form of profit problem at least once during your rounds of consulting interviews. In fact, in our 2023 analysis of the most common case study interview questions at McKinsey, BCG and Bain, profit improvement questions topped the list, accounting for 20% of the case questions reported.

Here’s a tried and trusted framework you can use to tackle profitability case questions with clarity and confidence.

The standard profit framework

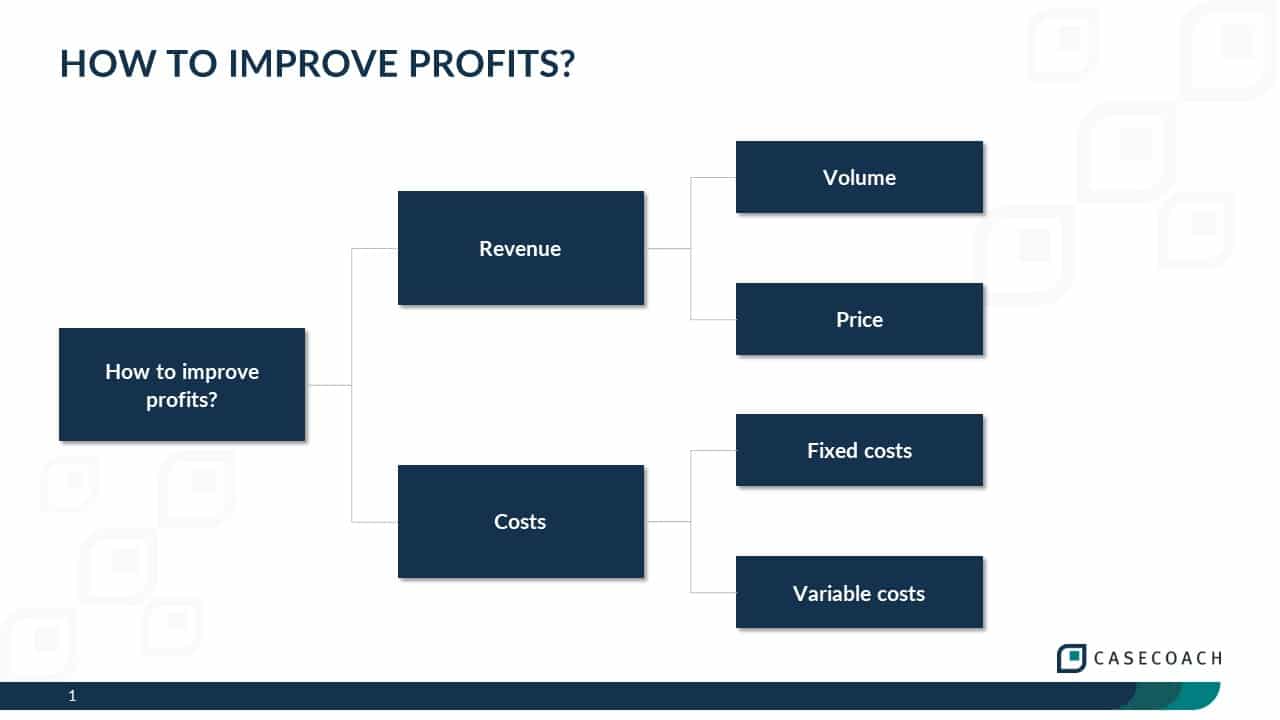

Profit is defined as revenue minus cost, where revenue is the quantity sold multiplied by the price of the product, and cost is the sum of all the expenses.

Your client could be a winemaker looking to increase their profits. In this instance, revenue is the number of bottles sold multiplied by the price of a bottle. Cost is the sum of the costs associated with growing and harvesting the grapes, aging and bottling the wine, distributing the product, and the overhead, including sales and marketing.

Costs are usually either fixed or variable:

- Fixed costs are those that don’t change with the quantity sold

- Variable costs normally fluctuate in proportion to the quantity sold

This standard approach to thinking about profit is illustrated in the diagram below:

The profitability framework for case questions

When it comes to answering a profitability question successfully in a case interview, simply applying the standard approach described above can’t help you determine how to either increase revenue or reduce costs. We’ve built on that framework to provide a more sophisticated approach to uncovering this vital insight.

1. Take multiple lines of business into account

Most companies will have more than one line of business. If your profitability case question is about a business with multiple units, product types or locations, you should first look at the profitability of each part of the business individually to eliminate the parts that are losing money.

If your winemaker client produces several types of wine, start by determining the profitability of each product and discontinuing any loss-making wines. Once you’ve done that, you can look at opportunities to increase revenue or decrease cost.

2. Consider the options for reducing cost

Instead of going through cost ‘buckets’ one after the other, as you would in the standard approach to thinking about profit, consider the following three drivers for reducing cost in this order:

- Reducing the need for what you’re buying

- Meeting the need with fewer resources

- Reducing the cost of the resources

Let’s say you’re looking at reducing call center costs for a utility company.

First, how can you reduce the need? You can do this by eliminating the issues that customers call about or by reducing the level of support that you provide to your customers.

The second driver is to meet the need with fewer resources. If you keep the volume of calls constant it’s about handling them with fewer operators by eliminating waste and improving productivity.

The third driver is reducing the cost of the resources. You can save costs – while keeping the call volume and number of operators the same – in two ways:

- Renegotiating costs

- Finding cheaper alternatives

Renegotiating costs might involve reducing salaries or benefits. Finding cheaper alternatives might mean offshoring staff to a lower-cost country.

3. Consider the options for increasing revenue

Finally, you should turn your attention to increasing revenue.

Thinking about this only as a factor of increasing quantity and price, as the standard approach does, assumes that you’re going to keep selling the same products. It also fails to provide any insight into how to increase price or quantity.

This is where the revenue growth framework comes in. It’s based on the principle that there are two main ways to grow a company’s revenue:

- Growing its core business

- Growing outside of its core business

To explore the possibility of growing the core business in your profitability case, you could focus on growing across current market segments. You could also consider investing in the fastest-growing segments in the market.

To explore the possibility of growing the business outside of its core offering, you could consider selling new products to current clients or leveraging capabilities to get into new business areas.

Your client is a car maker with a strong presence in the SUV market.

To grow the core business, the client could continue to focus on the SUV market by making better products, improving marketing, and offering competitive prices.

Alternatively, they could grow outside of their core business by selling new products – such as insurance, maintenance plans and leasing – to their current clients. They could also use their capabilities to get into new business areas, such as trucks, buses or motorbikes.

The line of investigation you choose to pursue will depend on a number of factors outlined in the case question, such as time horizon, market maturity, and the position of the company in its market.

In any case, this more sophisticated way of thinking about profit will help you draw out useful insights that you can use to deliver a strong recommendation to the client in a profitability case question.

You can learn more about how to use this profitability framework – along with nine other frameworks that will help you answer the most common case interview questions – in the Case Interview Prep Course, included in our Consulting Interview Prep Toolkit.

Designed to teach you how to tackle each dimension of the case and fit interviews, the Toolkit contains all the online courses, sample interviews, case material, and practice tools you’ll need to ace any consulting interview. This includes access to our Case Library of over 100 cases, which span a range of sectors, functions and question types, including profit improvement.