This article was written by Wasim Tahir, a former Oliver Wyman and BCG consultant who has worked in several financial institutions, including Credit Suisse, Lloyds Banking Group, and CDC Group (impact investing). Wasim has coached many candidates for case interviews with firms such as American Express, Capital One, and Credit Suisse.

Case interviews are a long-standing feature of the interview process at both financial institutions and consulting firms that serve financial services clients, like Oliver Wyman.

These employers use case interviews to assess candidates against the same dimensions as the world’s top management consulting firms. However, the content of the cases that they give is very different.

In this article, we explain these differences and provide some guidance on how to prepare.

What’s unique about financial services cases?

Financial services institutions and consulting firms like Oliver Wyman require candidates to demonstrate a solid understanding of the financial services industry. They assess this by using case interviews focused on financial services and by including questions about technical topics such as financial regulations, technology, and financial metrics.

Here are some examples of the kinds of questions you might be asked in a financial services case interview:

- What is the size of the market for credit cards in the UK?

- A leading online trading platform is looking to expand into new geographies. How would you decide which market to enter?

- A major bank is considering entering the cryptocurrency market. How would you evaluate the opportunity and risks involved?

- A bank is planning to launch a new credit card targeted at young professionals. How would you go about deciding the features of the card?

- A regional commercial bank has seen its profitability decline, despite stable revenue. How would you turn the situation around?

- A leading financial services company is looking to grow its personal loan business. How would you help it develop a customer acquisition strategy?

How should you prepare for a financial services case interview?

As a baseline, you should be able to excel in all the dimensions assessed in a case interview. The The Case Interview Prep Course, included in CaseCoach’s Consulting Interview Prep Toolkit, cover all of these dimensions. The Toolkit also includes sample interviews, case material, and practice tools designed to support your preparation.

In addition, you should take the following measures to prepare for financial services interviews specifically:

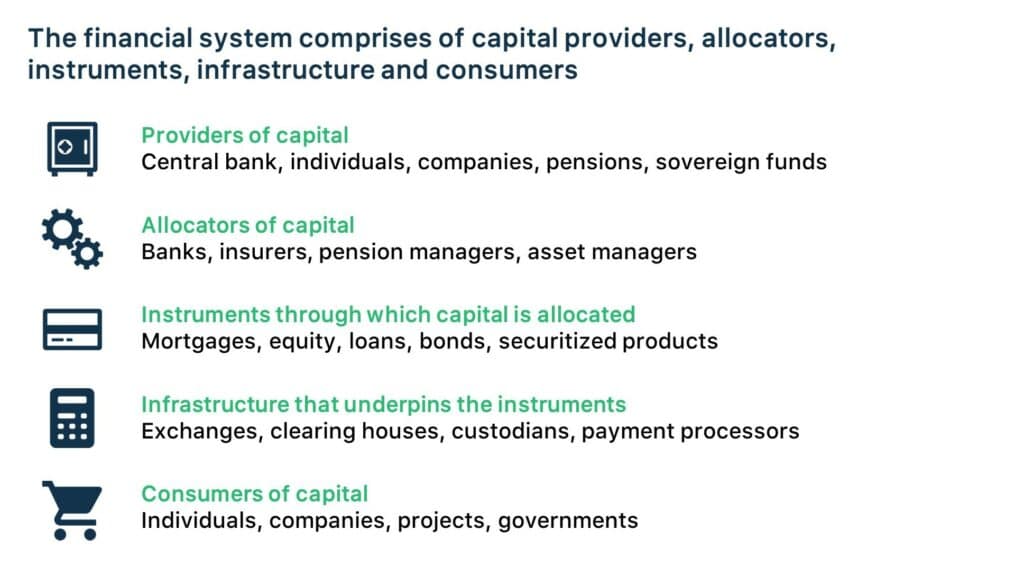

- Form a helicopter view of how the financial system works in order to fulfill its key objective: intermediating capital.

- Learn about the role that different types of financial institutions and instruments play in the financial system (as shown in the illustration below).

- Understand the operating model of the type of financial institution you’re interviewing for. For example, the operating model of a lender – which will be different to that of a transaction bank or an investment bank – can be broken down into three key areas: underwriting, distribution and collections, and recoveries.

- Know the unique structure of financial statements and the metrics that financial institutions use to measure performance. These include key ratios such as Net Interest Margin and Tier 1 Equity.

- Be aware of the major economic, regulatory, and technological drivers that affect the industry.

Preparing for the assessment dimensions of the case interview and deepening your knowledge of the financial services industry should stand you in excellent stead for succeeding in a financial services case interview.